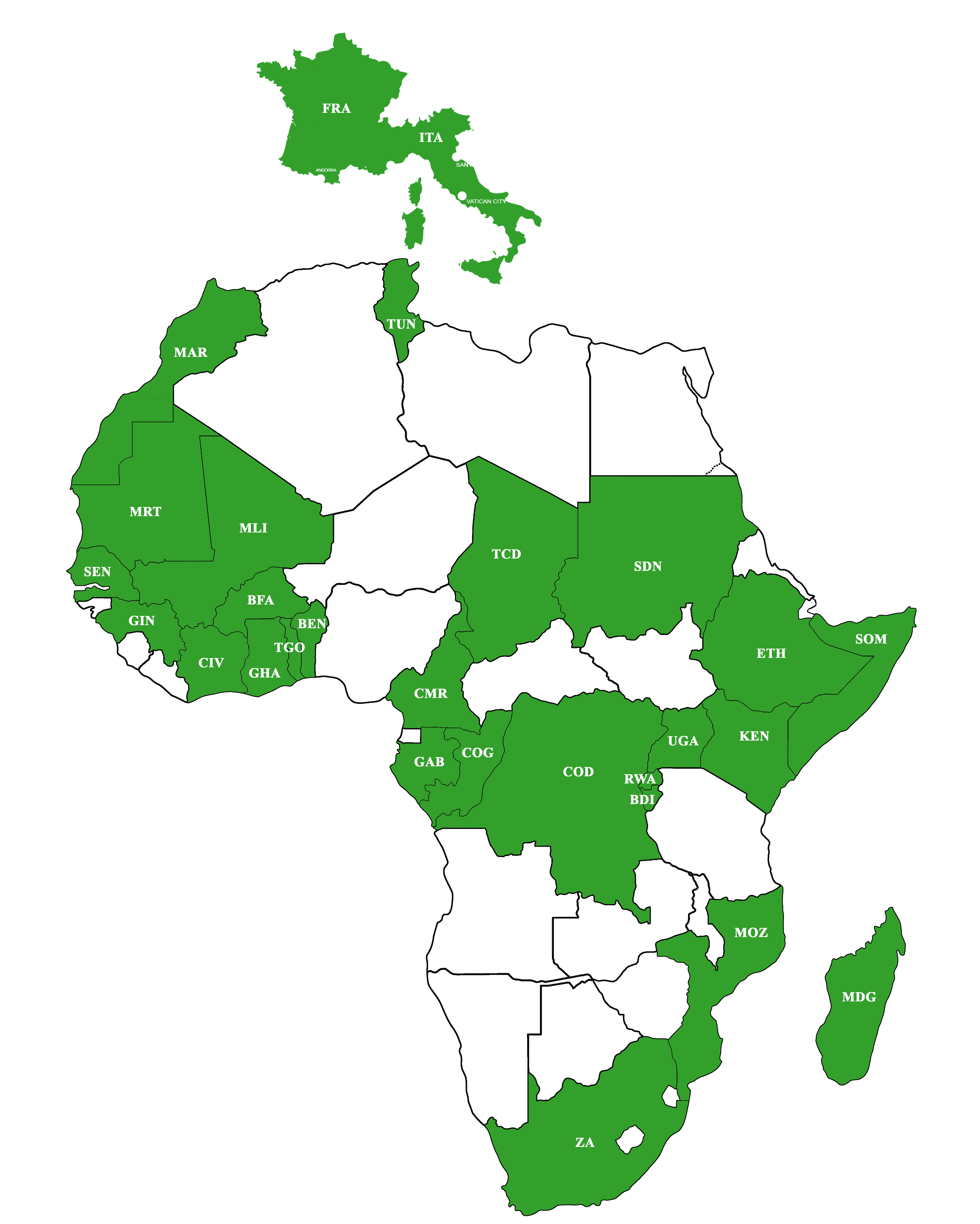

MAIN investigation on COVID-19

During the month of April, MAIN sent to its member institutions, a questionnaire on the impact of COVID-19 on their activities. Responses were collected in sufficient numbers for a representative sample to highlight the following ongoing issues:

- Decrease of deposits and increase of withdrawals from clients

- Difficulties in recovering outstanding loan

- Significant lack of liquidity

- Difficulty moving through national territories

- Costs and logistics of implementing barrier measures

The data collected were used to design an emergency technical assistance program to address the consequences of COVID-19. MAIN has therefore offered technical assistances to the most affected institutions consisting in:

- Stress-test with the Microvision tool

- Reviewing of MFIs strategic plans

- Design of Business Continuity Plan (BCP).

The network was also involved in the commitment to the “key principles to protect MFIs and their clients in the COVID-19 crisis ”. These principles, drawn from investors and key players in the sector, specify the conditions for renegotiating MFIs’ loan in this time of crisis.

WAEMU: Microfinance situation as of December 31,2019

In May, the West African States Central Bank published figures for the inclusive finance sector for the fourth quarter of 2019. Without yet reflecting the pandemic context of COVID-19, the report indicates that WAEMU had 508 microfinance accredited institutions as of December 31th, 2019 and served more than 14.5 million customers across 7,905 points of service. The outstanding credit portfolio of the Union’s MFIs was FCFA 1 555.6 billion ($ 2.7 billion), an increase of 10% over the previous year. The volume of savings was FCFA 1 473.7 billion ($ 2.5 billion), a decrease of 18.5%. Finally, the gross rate of deterioration in the average Union’s MFIs portfolio was 6.1%, compared with 7.1% at the end of 2018.

source:https://www.bceao.int/sites/default/files/2020-05/BCEAO%20-%20Situation%20de%20la%20microfinance%20dans%20l%27UMOA%20%C3%A0%20fin%20d%C3%A9cembre%202019.pdf

Cash shortage: How long will MFI be able to hold?

In this time of crisis, all players in the financial inclusion sector are concerned about the shortage of liquidity caused by deposit withdrawals, operating costs and maturing receivables, the latter factor was the most worrying. Based on the collected data, it appears that 46% of MFIs would have no problem covering one year of normal operations, while 35% would be able to assume at least six months of operation. The most fragile situations, with reserves covering a maximum of two months of operation, concern 19% of the world’s institutions.

source: https://www.findevgateway.org/fr/blog/2020/06/combien-de-temps-les-institutions-de-microfinance-peuvent-elles-tenir-face-la-penurie?utm_source=FRENCH+Weekly_Update_%239_June+8_2020&utm_campaign=French+COVID+Weekly+Update+%239&utm_medium=email

Remittances decline in Africa: What are the consequences for poor households?

The amount of money sent to Africa by its diaspora has been multiplied by 10 in 20 years, from $4.8 billion in 2000 to $48 billion in 2018. From 21.6 million in 2000, the number of migrants from Africa raised to 36.3 million in 2017.

In Nigeria, remittances from abroad amounted to $25 billion in 2018, nearly four times more than foreign direct investment and official development assistance combined. In Lesotho, they accounted for 16% of GDP. But those numbers should change. The World Bank’s latest report on migration and development concludes that international money transfers to Saharan Africa will decline by 23% in 2020 as a result of the COVID-19 pandemic, with significant implications for the major recipient countries in the region.

source: https://blogs.worldbank.org/fr/africacan/covid-19-et-baisse-des-envois-de-fonds-nationaux-en-afrique