About us

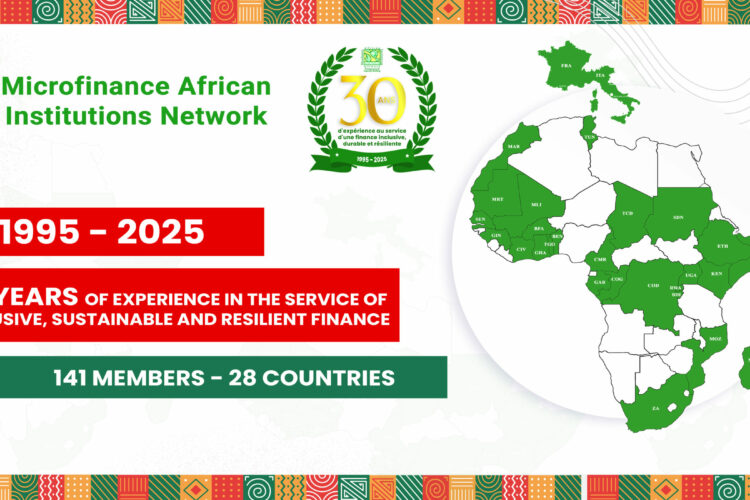

MAIN (Microfinance African Institutions Network) is an international nonprofit making association established in 1995 in Ivory Coast through the initiative of several institutions (CERUDEB, SIPEM, SIDI, FIDI & IDM) with long experience in microfinance and/or promoting microenterprises in Africa.

Learn moreOur activities

We strengthen the internal capacities of the micro-finance institutions, help to facilitate and promote exchange of information in the microfinance sector and provide for documentation of existing know how and the practices, and production of methodological materials.

Learn moreWork with us

African and non african institutions or organization that provide financial and/ or technical assistance to African micro-economic operators can be members of MAIN. You can apply today to join our network. As at September 30 th 2025, MAIN counts 149 members from 27 countries.

Become a memberOur latest updates

National Week of la Microfinance – Benin

Conference Center, CotonouSAM 2025 – Nairobi

Nairobi, KenyaHighlights from SeNaMif and the Celebration of the 30th Anniversary of MAIN

Relive the key moments of the 2025 National Microfinance Week in Cotonou and the 30th anniversary celebration of MAIN — a week of dialogue, partnerships, culture, and shared experiences.

MAIN General Assembly – September 25, 2025, Cotonou, Benin

From September 22 to 25, 2025, the National Microfinance Week (SeNaMif) was held in Cotonou under the theme " Inclusive finance in Africa in the context of climate and security challenges." This event brought together more than 300 participants from 20 mainly African countries and highlighted the key challenges facing the African financial sector, which is particularly exposed to climate and security risks that threaten both the stability of the sector and financial inclusion...

social