Download the registration form here

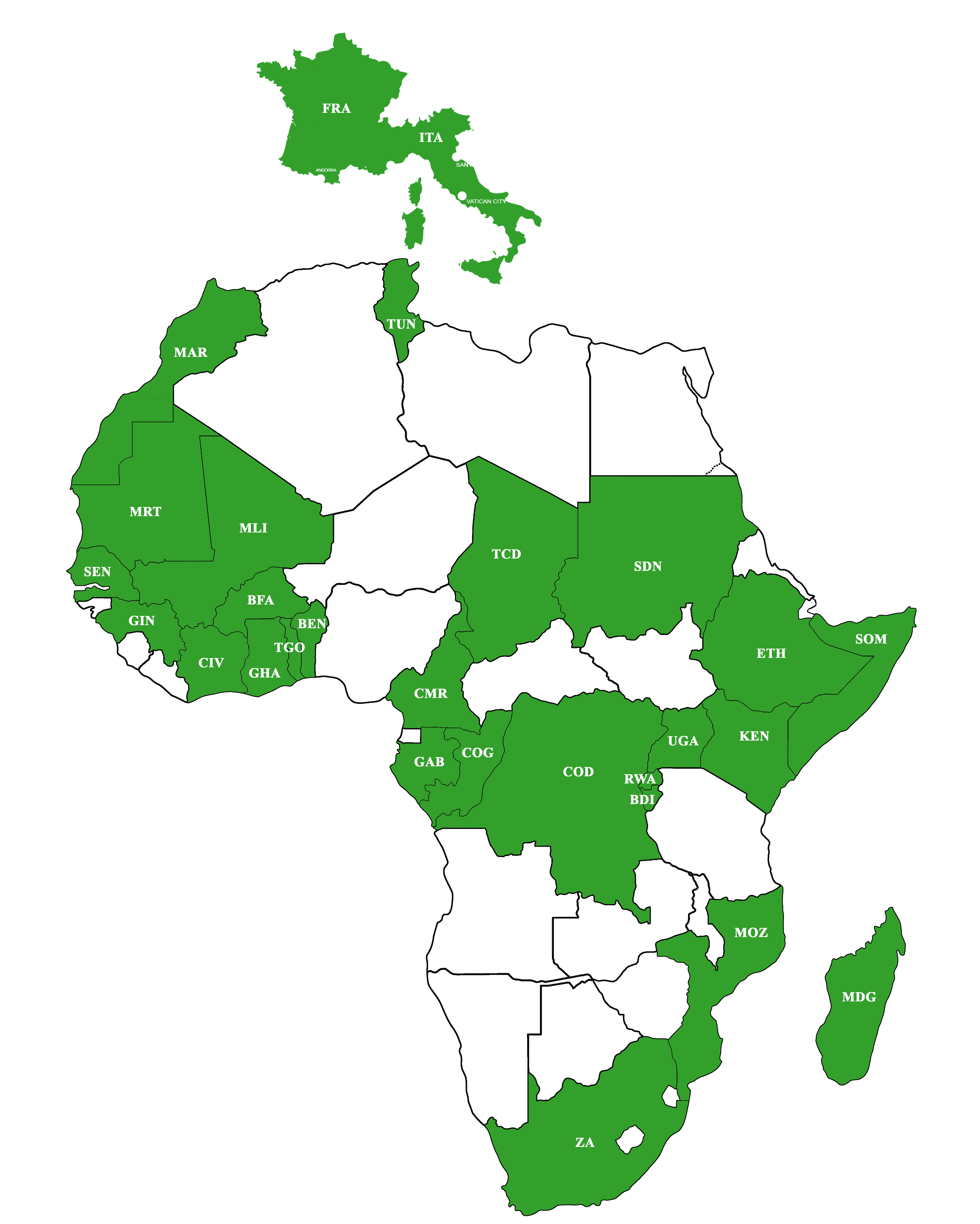

As part of its capacity building program, MAIN organizes in collaboration of AEMFI a training on Environmental sustainability strategies. Environmental sustainability strategies are vital for MFI. It has become a paramount concern in recent years, as the world grapples with the far-reaching consequences of climate change, resource depletion, and biodiversity loss. The main environmental problems include land degradation, soil erosion, deforestation, loss of biodiversity, desertification, recurrent drought, flood and water and air pollution. In this context, the role of MFI in promoting and implementing environmental sustainability strategies has gained significant attention.

MFI are increasingly recognising that environmental sustainability is not just a moral obligation but also a critical component of their long-term viability and success. That is why MAIN in its activities plan for 2024, had plan a training on environmental strategies for MFI. The training will give employees and managers knowledge and awareness that allows them to move forward in a sustainable way, and the confidence to promote change within the organisation.

The objective of this training is to aware the participants to acquire sensitivity to the environment and its problems and help them to acquire a set of values for environmental protection.

Expected results

At the end of the training, participants will be able to:

- Define green finance

- Understand vulnerability in environmental context

- Mitigate & adapt strategies

- Identify green risk in MF

- Overview green financial products

- Integrate sustainability into organizational goals & MF operations

- Report progress to stakeholaders

Quantify & report environmental impact reduction

Contents

The courses is composed of 15 modules as detailed below

Day 1: Introduction and Foundations

Module 1. What is Inclusive Green Finance? (1 hour)

- Definition of Green Finance

- Principles of Inclusive Green Finance

- Importance in Sustainable Development

- Case Studies: Financial Institutions and Green Finance

Module 2. Vulnerability and Negative Environmental Impacts (1 hour)

- Understanding Vulnerability in Environmental Contexts

- Key Environmental Risks: Climate Change, Biodiversity Loss, Pollution

- Assessing Negative Environmental Impacts

- Mitigation and Adaptation Strategies

Module 3. Advantages of Green Products and Their Multiple Services (1.5 hours)

- What Are Green Products?

- Ecosystem Services Linked to Green Products

- Economic and Social Benefits

Module 4. Green Index and USSEPM (2 hours)

- What is a Green Index?

- Importance of Measuring Green Performance

- USSEPM: Key Indicators and Frameworks

- Adapting Standards for Financial Institutions

Module 5. Green Risk and Opportunity Management (1.5 hours)

- Identifying Green Risks in Business

- Turning Environmental Challenges into Opportunities

- Risk Assessment Tools

Day 2: Developing Environmental Strategies

Module 6. Green Products and Services (1 hour)

- Overview of Green Financial Products and Services

- Types of Green Products: Loans, Bonds, and Investments

- Challenges in Promoting Green Products

Module 7. Green Products and Services – The Advantages (1 hour)

- Environmental, Economic, and Social Benefits

- Market Demand for Green Products

- Enhancing Competitiveness with Green Products

Module 8. Environmental Strategy (1.5 hours)

- Steps in Creating a Comprehensive Environmental Strategy

- Integrating Sustainability into Organizational Goals

Module 9. Defining Green Policy and Environmental Strategy (2 hours)

- Green Policy vs. Environmental Strategy

- Key Components of a Green Policy

- Developing Policy to Address Environmental Priorities

Module 10. How to Develop a Green Agenda for an MFI (2 hours)

- Green Finance for MFIs

- Steps in Building a Green Agenda

- Integrating Environmental Goals in Microfinance Operations

Day 3: Implementation and Monitoring

Module 11. Monitoring Green Strategy and Progress (1.5 hours)

- Key Performance Indicators (KPIs) for Green Strategies

- Tools for Monitoring and Evaluation

- Reporting Progress to Stakeholders

Module 12. Managing Environmental Strategy: The Green Process, Tools (1.5 hours)

- Key Phases in Environmental Strategy Management

- Tools for Strategy Implementation

- Engaging Stakeholders in the Green Process

Module 13. Monitoring Progress in Implementing Green Strategy (1.5 hours)

- Techniques for Tracking Strategy Implementation

- Using Data to Measure Success

- Case Studies: Monitoring in Action

Module 14. Monitoring Vulnerability Reduction (1 hour)

- Framework for Measuring Vulnerability

- Indicators for Monitoring Reduction

- Tools for Data Collection and Analysis

Module 15. Monitoring Reduction of Negative Environmental Impacts (1 hour)

- Quantifying Environmental Impact Reduction

- Environmental Audits and Compliance Checks

- Reporting Environmental Impact Reductions

The training will run from Nov 20-22, 2024.

Deadline for registration is October 25th, 2024

The following requirements should be fulfilled to attend the program.

A registration fee of USD 100 as member to be paid to MAIN and USD 150 for non-member of MAIN based in Addis, USD 600 for international participants who are MAIN member

Registrations form should be sent to main@mainnetwork.org with copy to info@aemfi-ethiopia.org & miheretab@gmail.com

Participants who failed to pay the registration fee will not be accepted by MAIN.

International Candidates are requested to arrange their own international travel and MAIN will make reimbursement up to USD 500 upon presentation of flight ticket receipt, and boarding pass along bank details immediately after the session is over. Please note that the cost of air ticket exceeding USD 500, the difference will be covered by the participant institution.

International Participants will be lodged by MAIN for 4 nights. Meals and rooms are provided by MAIN for international participants.

Member institutions are requested to clear their arrears of annual contribution to MAIN before attending the training.