Training on digital Finance in Bukavu

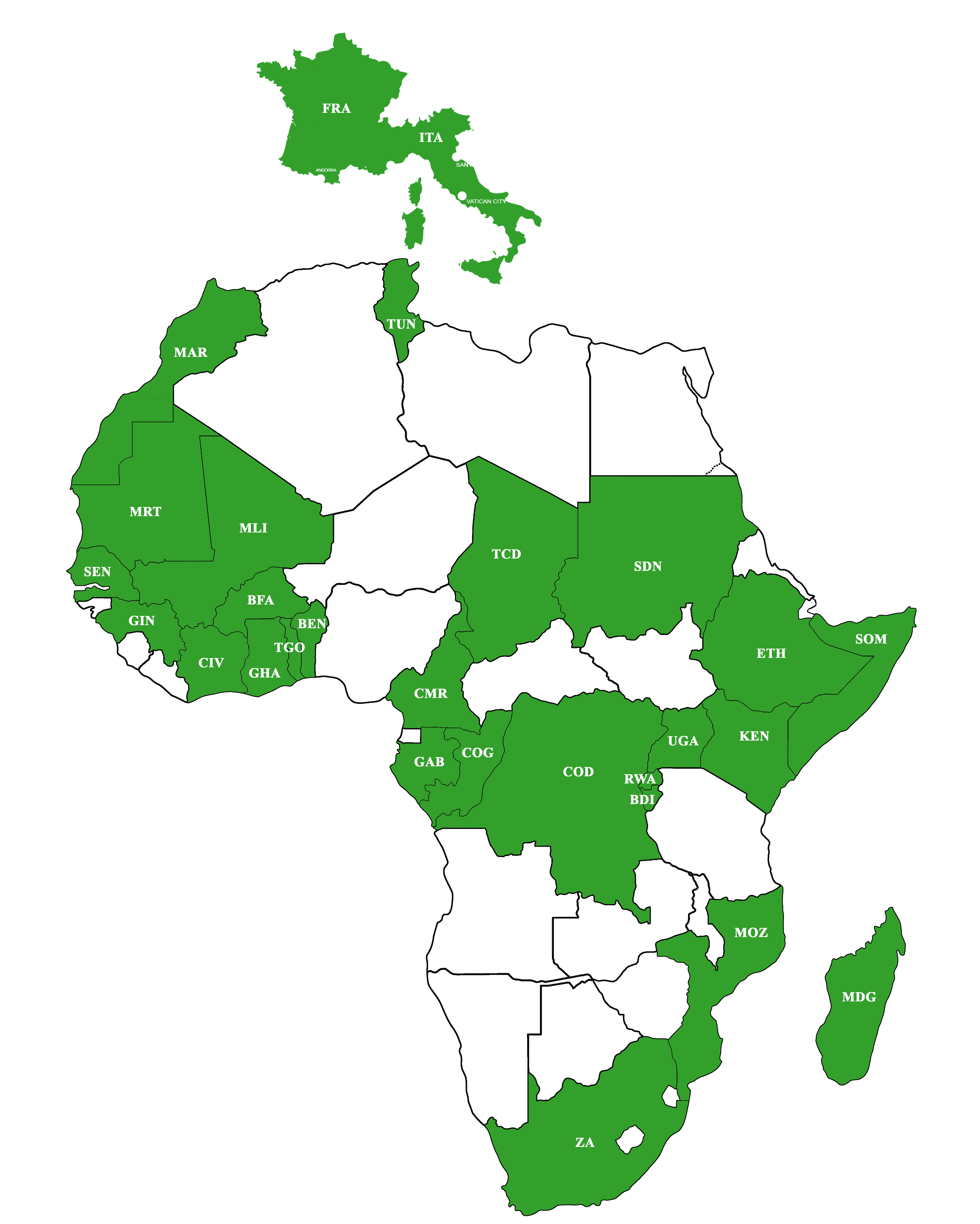

In collaboration with GAMF (Group of actors of Microfinance of Kivu), MAIN (Microfinance African Institutions Network) organized a training on “digital finance” from June 4th to June 8th, 2018. This sub regional training of microfinance actors took place at the AMANI Center in Bukavu, Democratic Republic of Congo.

Thirty-two participants from the Democratic Republic of Congo (South Kivu, North Kivu and Kinshasa), Chad and Burundi took part in the training.

The opening ceremony of the training took place in the presence of the financial advisor, representing the governor of South Kivu. In his speech, the representative of the Governor welcomed the participants and urged them to participate actively in this training which became a hot topic in the finance sector in general and in the microfinance sector in particular.

The aim of the training was to explain the different aspects of a digital finance project and to increase the capacity of the participants to be able to formulate the outline of a digital finance project for a microfinance institution. Ten modules have been developed during this very practical training with concrete case studies.

The closing ceremony of the training was held on Friday, June 8th, with representatives of the organizers (MAIN & GAMF) and the provincial authority (representative of the Governor of the province of South Kivu). At the end of the speeches, training certificates were given to the participants.

Training program at the Catholic University of Central Africa

The 2018 Master’s degree program in Management of Microfinance Institutions organized in partnership with the Catholic University of Central Africa (UCAC) & MAIN was held from August 13 th to September 1st, 2018. Twenty-five (25) participants (08 in Workshop 1 & 17 Workshop 2) from 21 institutions in 11 countries took part in the session.

The opening of the workshops on 13th August was made by Prof. Jean Robert KALA in the presence of the MAIN program officer.

Two major events marked the 2018 session. First, seventeen participants defended their Master’s thesis in front of a jury. The themes of their dissertations covered different topics (credit management, risk management, human resources management, information system management, governance, etc.).

Then, 13 years after the program was set up, the first formal graduation was held on Saturday, September 1st, 2018. Several speeches marked this graduation ceremony. These include the address of the Vice-chancellor of the University, the speech of the chairman of MAIN, the speech of the recipients, and the one from the participants at the 2018 session. All stressed the importance of this training in their daily work and thanked MAIN and UCAC for having set up this master. The evaluations of the different workshops showed a very high level of satisfaction from the participants. This demonstrates the effectiveness and relevance of this program.

The certificates for graduate students were given by the Vice chancellor of the university, while the participants certificates for the 2018 session were handed by the Executive Director of the MAIN.

Training at the UMU

The UMU 2018 residential session was held from July 22th to August 4th in Ngozi. The training brought together participants from Ethiopia, Uganda, Rwanda and Kenya. More than 100 participants took part in this session of 2018. MAIN sponsored a total of 21 participants.

It should be noted that UMU launched this year, the master in management of MFIs. The MAIN has sponsored 5 members to take part in this master program. The inter-sessional courses will begin on January 2019.

Training on savings mobilization

From August 13th to 16th 2018, MAIN has organized a training course on savings mobilization in collaboration with the Association of Ethiopian Microfinance Institutions (AEMFI). The training brought together 22 participants from Rwanda, Uganda and Ethiopia.

The overall objective of the workshop was to allow participants to have a more in-depth understanding of the savings mobilization and its implementation in microfinance institutions. During the course of the training several topics were presented to the participants. Among other things we can quote: what it means to be a saver, savings & customers, why save? How to implement a strategy to mobilize savings in microfinance institution?

Each sub-session is supported by concrete examples and short video sequences. Everything was made to show participants the importance for microfinance institution to mobilize local savings. In the course of the session, the facilitator also presented the 7 habits of highly effective people of Stephen R. Covey.

The session was very interactive and practical for the participants. The analysis of the evaluation forms showed that the facilitator approach was very much appreciated. The participants in their recommendations asked that MAIN organize other sessions of its kind in Addis for those who did not have the opportunity to participate in this session. The closing of the training was done by the director of MAIN who urged participants to make good use of what had been thought during the session. The certificates were handed by the facilitators and the executive director of MAIN.

Training on the use of the Microfact Factsheet MFI tool

From September 3rd to 5th, 2018, MAIN network has organized, in collaboration with APSFD-Togo, a training workshop on “financial and social performance indicators of MFIs” which gathered 30 participants from 7 countries (Benin, Madagascar, Guinea, Burkina-Faso, Niger, Chad and Togo) and 20 microfinance institutions. The training took place at the Hotel BKBG of Baguida on the outskirts of Lomé.

This training was about the use of the Microfact Factsheet MFI tool, referring to the field of MFI performance analysis. The creation of the Factsheet tool was made possible by ADA in Luxembourg and BRS in Belgium. This tool allows to combine the financial data of an MFI over several years into a single file and to extract the main performance indicators. The Factsheet MFI tool uses the Microfact methodology, which proposes 16 main indicators divided into 4 categories:

- Portfolio Quality

- Efficiency and productivity

- Financial Management

- Profitability and viability

The objective of the training was to provide participants with an efficient and standardized tool to ensure and improve the management and reporting of their institutions.

The training was carried out by a certified consultant on the utilisation of the tool. The training was very practical, dynamic and participatory. The analysis of the evaluation form shows a high level of satisfaction from the participants. The closing ceremony and attestations distribution were made by the Executive Director of the MAIN who encouraged the participants to share the learning outcomes with their colleagues once back in their respective institution.

Access to credit for refugees

The Grameen Credit Agricole Microfinance Foundation, the Office of the United Nations High Commissioner for Refugees (UNHCR) and the Swedish International Development Cooperation Agency (SIDA) are joining forces to develop a program to promote access to credit for refugees and host communities.

Often perceived as a too risky clientele, refugees are generally not served by financial service providers. However, the needs of these populations are significant and access to the financing of income-generating activities can contribute to their social inclusion.

In order to address this issue, the Office of the United Nations High Commissioner for Refugees (UNHCR), the Swedish Cooperation Agency and the Grameen Agricultural Credit Foundation are working together to prepare an access to credit program for Refugees and host communities. The first pre-study phase has just been completed.

Central Africa: A new regulation for microfinance institutions

The regulator announced that it had established a transitional phase of two years prior to the entry into force of the new regulatory scheme on the conditions of exercise and control of microfinance activity in Central Africa. In anticipation of the evolution of the regulatory framework, the Central African banking Commission (COBAC) organised on 26 June 2018 in Yaoundé a seminar to disseminate the new mechanism concerning the conditions of exercise and control of microfinance’s activities in the Economic and Monetary Community of Central Africa (CEMAC). The results of the various on-site surveys conducted by the COBAC with microfinance institutions have highlighted various weaknesses in the regulatory scheme of 2002, which was no longer suitable for the socio-environmental Economic and legal framework in which microfinance institutions progress and the many and various changes recorded by this sector in recent years.

http://www.lesafriques.com/actualite/afrique-centrale-un-nouveau-dispositif-pour-les-etablissements-de-microfi.html?Itemid=89

Upcoming events

Training : Excellence in risk management in microfinance

Place : Training center of the Chamber of Commerce of Luxembourg

Language: anglais (traduction simultanée en français possible)

Date : November 12th to 16th, 2018

Mooc : Energy and ecological transitions in Southern countries

Type: Online training

Place: Online

Date: From October 15th to November 23th, 2018

Financial Inclusion: Implications and lessons learned for regulators and policymakers

Type: Training

Place: Kigali, Rwanda

Date: From October 22th to 26th, 2018

Training on Social Performance Management

Type : Training

Place : Cotonou, Benin

Date : November 2018

Training of trainers on the Transparency Index Tool

Type : Training

Lieu : Lomé, Togo

Date : Octobre 22th, 2018

Training on the Transparency Index Tool

Type : Training

Lieu : Lomé, Togo

Date : October 23th to 25th, 2018